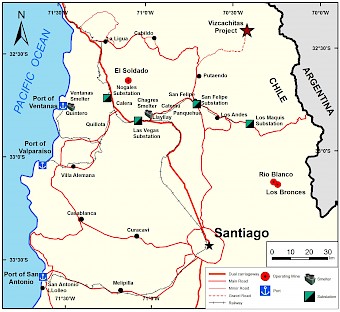

Los Andes is developing its 100% owned Vizcachitas copper-molybdenum project as Chile’s next major copper mine. Vizcachitas is a Tier 1 mining project with a large resource which remains open in most directions. Located in the Andes in Central Chile at low altitude, it is in the same region as a number of other giant porphyry deposits which are already successful mines including El Teniente (108 billion pounds contained copper), Rio Blanco (101 billion pounds contained copper), Los Pelambres (54 billion pounds contained copper) and Los Bronces (25 billion pounds contained copper). It benefits from excellent existing infrastructure including transport, power and access to desalinated water as well as year-round working conditions.

Concentrates would be transported in rotainers by truck 145km to the Port of Ventanas with the Ports of Valparaiso and San Antonio also options. There are 35km of existing roads that would require upgrading between Vizcachitas and Putaendo. Rail transportation from San Felipe to any of the three ports is a further alternative to be evaluated.

Connection to the national grid would be via a 60km line.

The PFS results announced in February 2023 demonstrate a 26-year open pit operation targeting 136,000 tpd which at US$3.68/lb Copper generates an after tax NPV @ 8% of US$2.776bn, returning an IRR of 24% and C1 cash cost of US$0.93/lb Cu for the first 8 years. The full report will be filed on SEDAR within 45 days replacing the June 2019 PEA.

The Initial Proven & Probable Reserves announced as part of the PFS are 1.219 billion tonnes at a copper equivalent grade of 0.41% with:

- 9.623 billion lbs of copper

- 365 million lbs of molybdenum

- 44 million oz of silver

The current Measured & Indicated Resources announced as part of the PFS are 1.541 billion tonnes at a copper equivalent grade of 0.436% with:

- 13.021 billion lbs of copper

- 526 million lbs of molybdenum

- 54 million oz silver

For the full Reserve and Resources Statement click here.

Metallurgical test work indicated high recoveries of clean copper concentrate with no off-take encumbrances.

Qualified Person Statement

Los Andes Copper activities are under the supervision of Mr. Amberg, CGeol FGS, Chief Geologist of Los Andes Copper Ltd. Mr. Amberg is a “qualified person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Amberg has approved the technical information in this presentation. For additional information regarding the Vizcachitas Project, see the technical report titled “Preliminary Economic Assessment of the Vizcachitas Project.”, with an effective date of May 10, 2019 prepared by Tetra Tech Chile S.A. (the “2019 PEA”), a copy of which is available on SEDAR at www.sedar.com under “Los Andes Copper Ltd.”.

Copper Equivalent grade for the PFS has been calculated using the following calculation: CuEq (%) = Cu (%) + 0.000288 x Mo (ppm) + 0.00718 x Ag (g/t).